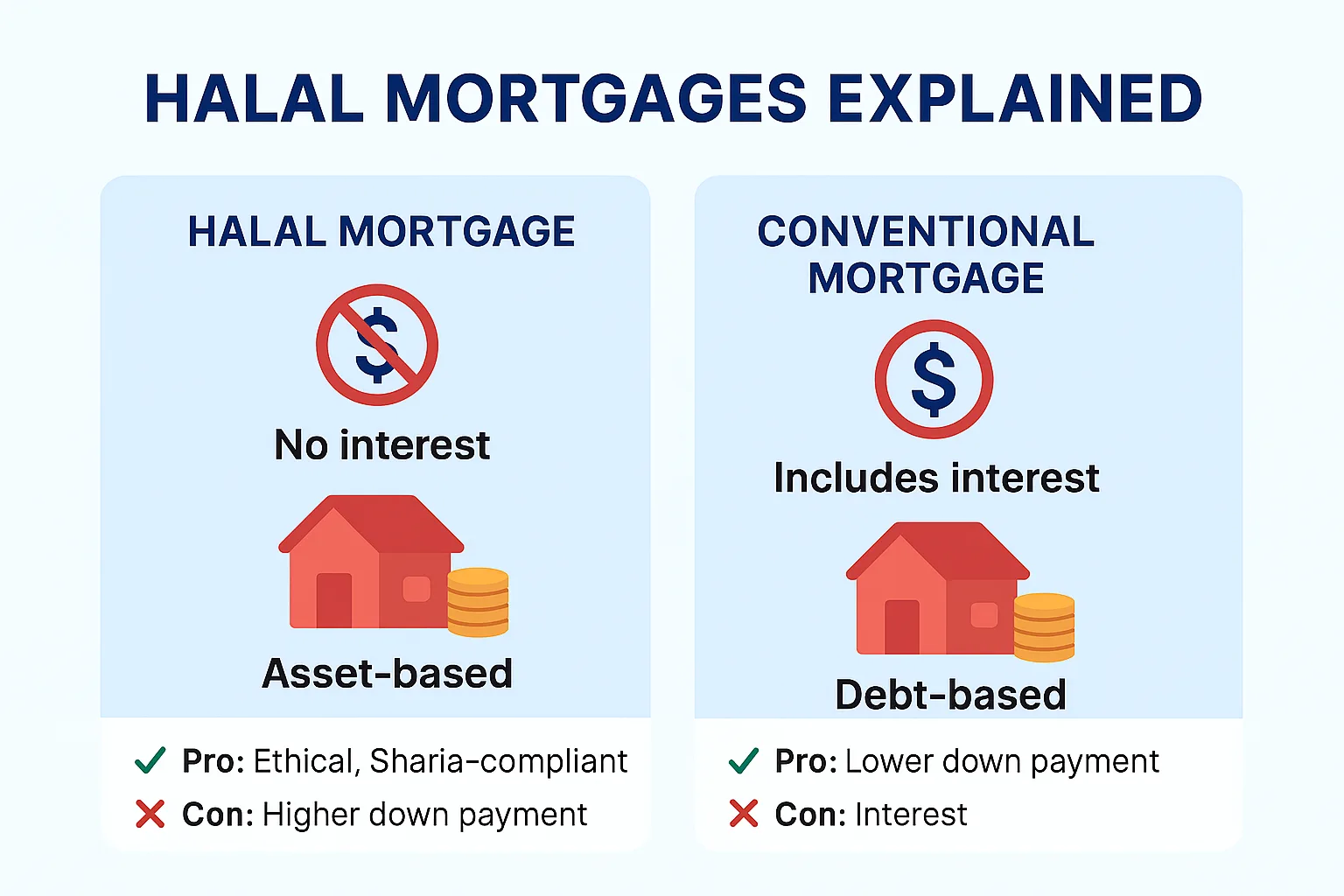

For Muslims worldwide, conventional mortgages pose a religious dilemma: Islam’s strict prohibition of riba (interest) conflicts with standard home loans charging compounded interest.

Halal mortgages resolve this by restructuring financing through Sharia-compliant contracts centered on asset trading, leasing, or co-ownership.

These models avoid interest while enabling home purchases—a market now exceeding $2.8 trillion globally, with the UK, US, Canada, and Malaysia leading adoption.

The Foundation: Why Interest Is Forbidden

Islamic finance adheres to principles from the Quran and Hadith.

Riba—any guaranteed interest charged on loans—is considered exploitative because it generates profit without labor or shared risk.

Instead, Sharia requires transactions to involve tangible assets and equitable risk-sharing. For home financing, this means banks cannot lend money at interest but must engage in real economic activity, such as owning or building property.

All contracts undergo vetting by independent Sharia supervisory boards comprising Islamic scholars who certify compliance.

Core Halal Mortgage Models

1. Murabaha (Cost-Plus Sale)

In Murabaha financing, the bank buys the property outright once the buyer selects it. The bank then sells it to the buyer at a higher fixed price—disclosing the original cost and agreed-upon profit margin upfront.

Payments are structured in installments over 5–30 years, replacing interest with a transparent markup. For example:

- Property cost: $300,000

- Bank’s profit margin: $50,000

- Total price: $350,000 paid monthly over 20 years

- Buyers typically provide 20–30% as a down payment. The bank crucially bears ownership risk during purchase. If the house burns down before the sale finalizes, the bank bears the loss—a key distinction from conventional loans.

2. Ijara (Lease-to-Own)

Ijara mimics rent-to-own structures. The bank buys the property and leases it to the buyer, who pays monthly “rent” while gradually purchasing equity shares. Each payment combines:

- Rent for occupying the bank’s share

- Principal to buy portions of the bank’s ownership stake

After 25–30 years, the buyer owns 100% of the home.- Early buyouts are permitted by purchasing the bank’s remaining equity. This model dominates in Canada and the UK, where providers like Manzil and Gatehouse Bank offer variable or fixed rental rates tied to market benchmarks.

3. Musharaka (Declining Partnership)

Musharaka means “partnership” in Arabic. Here, the bank and buyer co-purchase the home (e.g., 80% bank, 20% buyer). The buyer pays monthly “rent” on the bank’s share while simultaneously buying chunks of that ownership. Each payment reduces the bank’s stake until full ownership transfers. Unique to Musharaka:

- Profits/losses from property value changes are shared proportionally

- Renovations require mutual consent

- Default penalties are donated to charity (no late fees)

This model is prevalent in Malaysia and Pakistan.

4. Diminishing Musharaka (Hybrid Model)

A modern evolution blending Ijara and Musharaka. The bank funds most of the purchase (e.g., 90%), while the buyer contributes 10% as equity. Monthly payments cover:

- Rent on the bank’s portion

- An additional sum to buy 1–2% of the bank’s equity monthly

Ownership transfers faster than in pure Ijara, often within 15 years.- Providers like Guidance Residential (USA) use this to mirror conventional mortgage terms while avoiding interest.

Operational Requirements & Costs

- Down Payments: Minimum 20% (vs. 3–5% for conventional loans)

- Ethical Screening: Properties cannot involve alcohol, gambling, or adult industries

- Fees: Structuring fees (0.5–2%), property valuation, and Sharia audit costs

- Profit Rates: Markups or rent rates benchmarked to LIBOR or local indices

- Foreclosure: Banks resell properties transparently; excess proceeds return to the buyer

Global Leaders & Regional Variations

| Country | Top Providers | Dominant Model | Unique Rules |

|---|---|---|---|

| UK | Gatehouse Bank, Al Rayan | Ijara | FCA-regulated; fixed-term leases |

| USA | Guidance Residential | Diminishing Musharaka | State-compliant partnership deeds |

| Canada | Manzil, UM Financial | Ijara | Tax recognition in 8 provinces |

| Malaysia | Maybank Islamic, CIMB | Murabaha | Government subsidies for first-time buyers |

Malaysia’s market is the world’s most mature, with Islamic mortgages holding 45% market share. The UK’s Financial Conduct Authority treats Murabaha as regulated mortgages, offering consumer protections.

Challenges & Criticisms

Critics argue some “halal” models functionally replicate interest:

- Profit Margins in Murabaha often mirror conventional interest rates.

- Lack of Standardization: Contracts vary by bank and country.

- Accessibility: Limited providers outside major Muslim communities.

Islamic scholars counter that structural differences matter: asset ownership, risk-sharing, and ethical oversight distinguish halal financing.

The Future: Fintech & Democratization

Startups like Wahed Invest (USA) and Hejaz (Australia) now digitize applications using blockchain for transparent profit calculations. Malaysia’s “Rent-to-Own” government initiative partners with banks to reduce down payments to 5%. In 2024, the UK’s first green sukuk (Islamic bond) raised £500 million for eco-friendly halal housing projects.

A Homeowner’s Perspective

Ahmed Hassan, a doctor in Toronto, used Ijara to buy his home:

“We paid 20% down, then $2,500 monthly—half ‘rent,’ half equity. After 12 years, we own 60% without compromising our faith. The bank took on risk when our basement flooded—that’s the justice Islamic finance promises.”

WhatsApp Channel

WhatsApp Channel

Instagram

Instagram

Facebook

Facebook

X (Twitter)

X (Twitter)